Agentic AI for Financial Portfolio Management

Agentic AI transforms portfolio management by monitoring markets in real-time, assessing risks, and automating decisions for smarter, stress-free investing.

Overview

A mid-sized wealth management firm was struggling to keep up with multiple client portfolios. Managers spent hours monitoring markets, assessing risks, and deciding when to buy or sell. Manual processes were slow and reactive, often missing short-term opportunities that could improve returns.

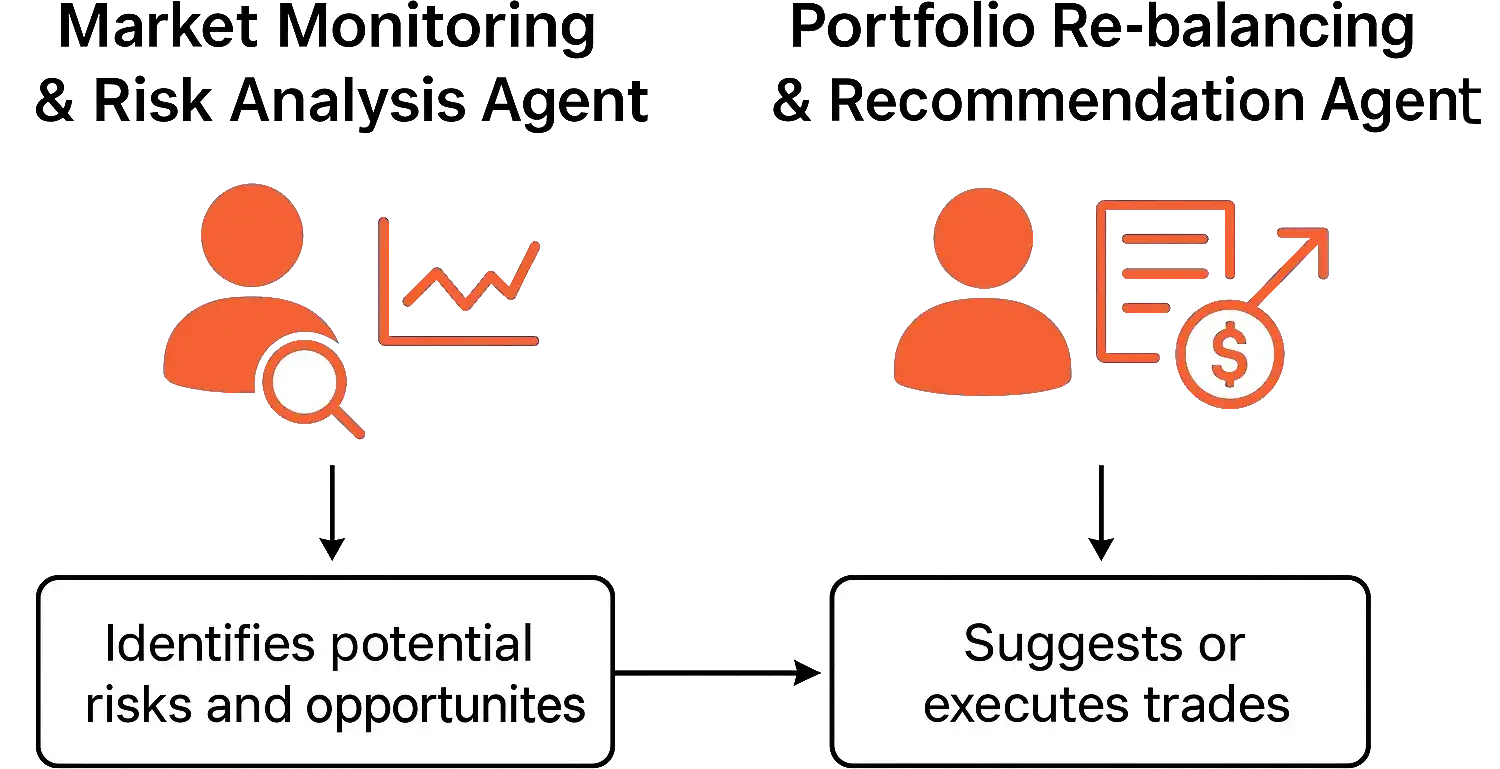

We introduced an Agentic AI solution that could watch the markets in real-time, analyze risks, and automatically rebalance portfolios based on client goals. This made portfolio management faster, smarter, and less stressful for the team, while giving clients better performance and more confidence in their investments.

Services

Industry Type